Before looking into savings strategies for a down payment on a home, it’s crucial to understand what lenders evaluate when approving a mortgage. Beyond just having enough money for a down payment, lenders assess your overall financial health to determine your ability to repay a loan.

1. The Importance of Your Credit Score

One of the most important indicators a lender will check is your credit score. A score of 740 or higher will secure the best mortgage rates and may even qualify you for lender incentives, such as better loan terms.

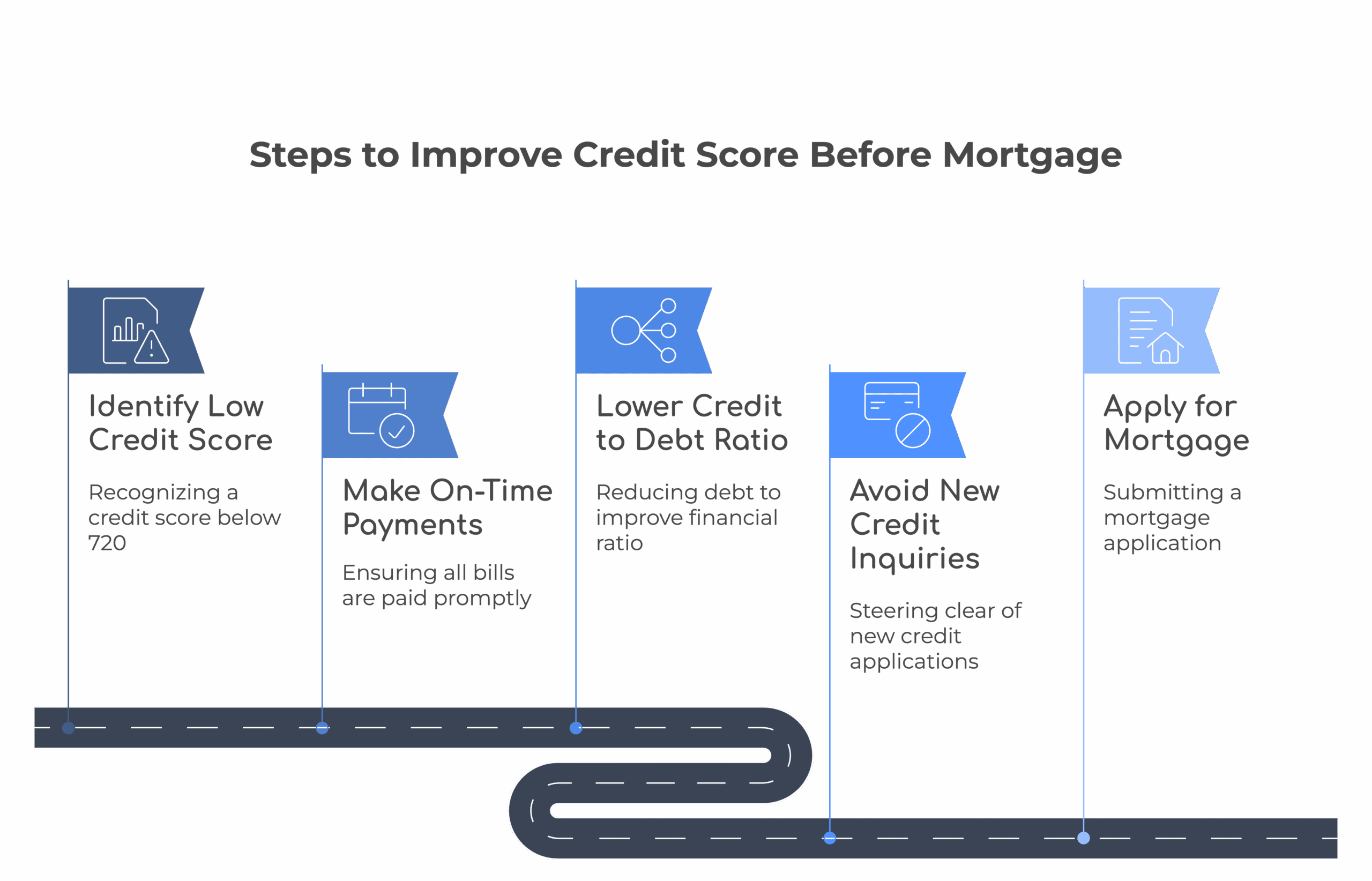

If your score falls below 720, you could face higher interest rates, increasing the overall cost of your loan. To improve your credit, focus on making on-time payments, lowering your credit to debt ratio by paying as much of your debt down as possible so your month over month available credit is as high as possible, and avoiding any new credit inquiries or applying for new credit cards, car loans, and etc. before applying for a mortgage.

2. Income Stability and Tax Returns

Lenders require at least two years of tax returns to verify income stability. For W-2 employees, this process is straightforward, as lenders can easily assess consistent income.

However, self-employed individuals and 1099 contractors face additional scrutiny since their net taxable income—the amount left after deducting business expenses—determines borrowing power.

3. Managing Debt and Credit Utilization

A common challenge for self-employed buyers is that taking too many tax deductions can lower their reported income, which in turn reduces the amount they qualify for when applying for a mortgage. While business expenses must be accurately reported, those planning to buy a home within the next two years should carefully evaluate their deductions.

Reducing discretionary business expenses where possible and maintaining a higher net taxable income can improve loan approval odds and increase borrowing capacity.

4. Bank Statements and Financial Reserves

In addition to credit and tax returns, lenders analyze your bank statements from the past two to six months to assess income consistency and spending habits. Large unexplained deposits or excessive withdrawals can raise red flags, making it essential to show steady, responsible money management.

5. Retirement Savings and Mortgage Eligibility

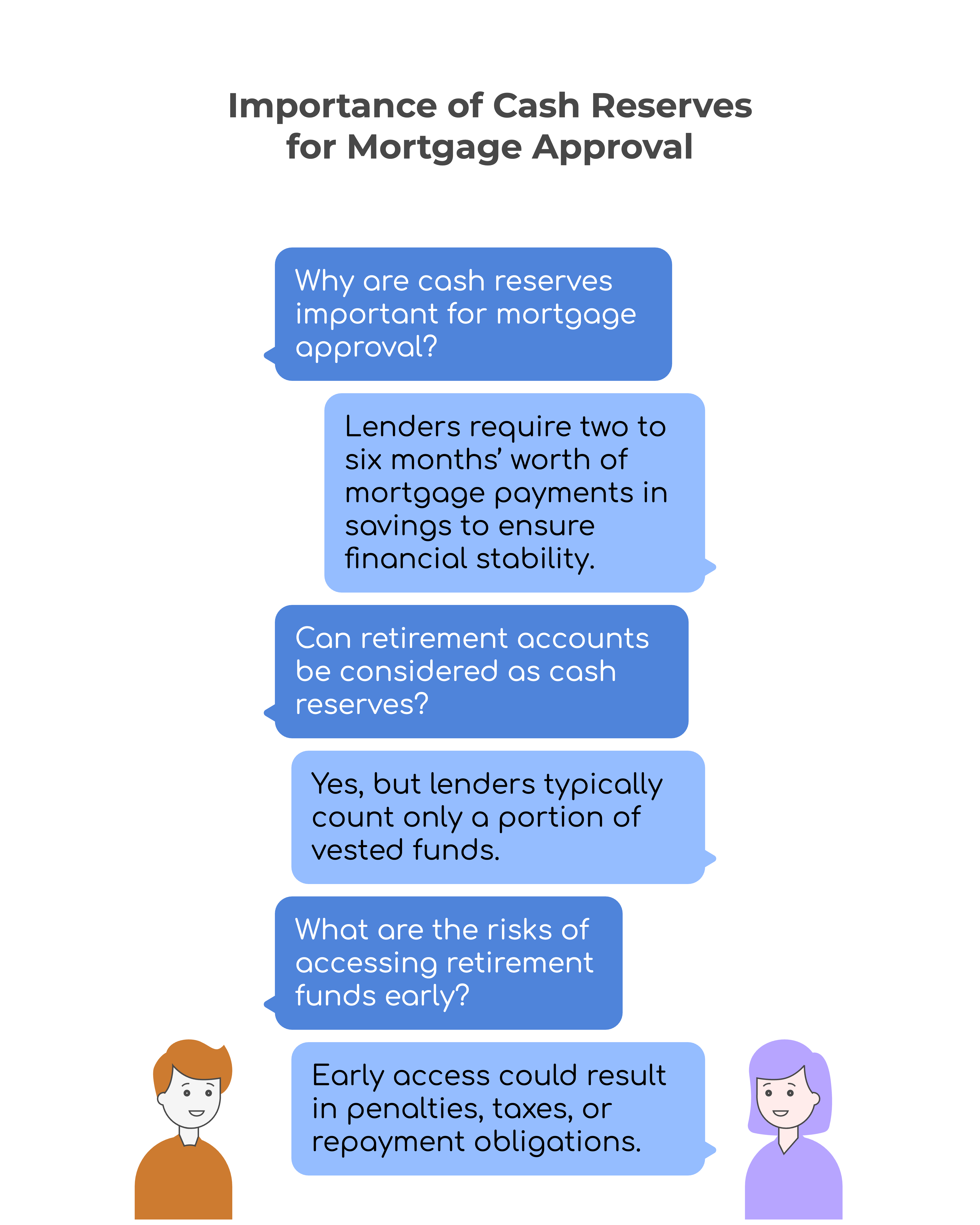

Having cash reserves is also crucial—most lenders require two to six months’ worth of mortgage payments in savings to ensure financial stability. While retirement accounts such as a 401(k) or IRA may be considered reserves, lenders typically count only a portion of vested funds, and accessing these funds early could result in penalties, taxes, or repayment obligations.

If you plan to use retirement savings as reserves, consult your lender to understand their specific guidelines.

—

Securing a mortgage is more than just having a down payment—it requires a strong financial profile that meets lender requirements. By maintaining a high credit score, managing debt responsibly, ensuring stable income, and keeping clear financial records, you can improve your chances of getting approved for the best possible loan terms.

For self-employed individuals and 1099 contractors, careful tax planning and maintaining a strong net taxable income can make a significant difference in borrowing power. Additionally, having cash reserves and well-documented bank statements will assure lenders of your financial stability.

If you’re planning to buy a home, take proactive steps now to strengthen your financial position. Consulting with a mortgage professional early in the process can help you navigate lender expectations and maximize your eligibility. With the right preparation, you’ll be well on your way to homeownership with confidence and financial security.

With over 30 years of real estate experience, Lawrence brings a family-focused approach to Real Estate. Starting early on by assisting his father with hands-on repairs and maintenance with various properties and later assisting with the backend operational processes, Lawrence along with his wife Melanie Leung have a developed multiple businesses focusing on all aspect of Real Estate including, but not limited to, Property Management, Investment Strategies as well as Buyer and Seller Representation. By working in multiple aspects of the real estate process, he brings a multi-faceted perspective to the buying and investment process. As a duo team with a strong knowledge of property investment, Lawrence is able to provide all the necessities an investor needs to make the smart choices.

With over 30 years of real estate experience, Lawrence brings a family-focused approach to Real Estate. Starting early on by assisting his father with hands-on repairs and maintenance with various properties and later assisting with the backend operational processes, Lawrence along with his wife Melanie Leung have a developed multiple businesses focusing on all aspect of Real Estate including, but not limited to, Property Management, Investment Strategies as well as Buyer and Seller Representation. By working in multiple aspects of the real estate process, he brings a multi-faceted perspective to the buying and investment process. As a duo team with a strong knowledge of property investment, Lawrence is able to provide all the necessities an investor needs to make the smart choices. Having grown up with parents working in real estate, I found my passion for this industry at an early age. I chose to follow in their footsteps after seeing how many clients they were able to help fulfill the American Dream of Home Ownership. After 7 years of working extensively in the San Francisco Bay Area, I have developed a keen understanding of the local market and always take the time to figure out what clients really need from me as a professional real estate broker. I take pride in serving my clients with the utmost level of care and professionalism. It is my job to ensure a smooth, worry-free, and satisfying experience for everyone involved.

Having grown up with parents working in real estate, I found my passion for this industry at an early age. I chose to follow in their footsteps after seeing how many clients they were able to help fulfill the American Dream of Home Ownership. After 7 years of working extensively in the San Francisco Bay Area, I have developed a keen understanding of the local market and always take the time to figure out what clients really need from me as a professional real estate broker. I take pride in serving my clients with the utmost level of care and professionalism. It is my job to ensure a smooth, worry-free, and satisfying experience for everyone involved.

Nathalie began her professional career in software and data management. Working with imperative government statistics, Nathalie developed a strong attention to detail and exceptional multitasking capabilities. As a technical support specialist in the IT industry, Nathalie began to deepen her desire to help people and provide excellent customer service. Driven by a mission to be user-centric and customer-focused, she approaches all customer interactions with sincerity and an eagerness for improvement. She’s your go-to person when you’re stuck, need help, or just need someone to listen.

Nathalie began her professional career in software and data management. Working with imperative government statistics, Nathalie developed a strong attention to detail and exceptional multitasking capabilities. As a technical support specialist in the IT industry, Nathalie began to deepen her desire to help people and provide excellent customer service. Driven by a mission to be user-centric and customer-focused, she approaches all customer interactions with sincerity and an eagerness for improvement. She’s your go-to person when you’re stuck, need help, or just need someone to listen. Erika May Roslin has a BA in Accounting and has professional experience working in finance and administration. She has a robust appreciation for accuracy and precision which makes her well equipped for bookkeeping within the real estate and property management industries. Erika has also developed excellent customer service skills and highly values customer satisfaction. She strives to make customers and clients feel happy with their products and services and seeks feedback to further improve operations.

Erika May Roslin has a BA in Accounting and has professional experience working in finance and administration. She has a robust appreciation for accuracy and precision which makes her well equipped for bookkeeping within the real estate and property management industries. Erika has also developed excellent customer service skills and highly values customer satisfaction. She strives to make customers and clients feel happy with their products and services and seeks feedback to further improve operations. Cherrylane has developed excellent customer service and conflict diffusion skills during her 20 years in the gaming and casino industry. Patience, honesty, and professionalism are at the heart of her commitments and honors her work with integrity and confidentiality. As Cherrylane pivots into the BPO (Business Process Outsourcing) industry, her advanced customer service experience is extremely useful in ensuring customer satisfaction and support. She has worked and interacted with people from diverse cultures and from all walks of life, making her personable and empathetic. We’re thrilled to have her as part of our operations team.

Cherrylane has developed excellent customer service and conflict diffusion skills during her 20 years in the gaming and casino industry. Patience, honesty, and professionalism are at the heart of her commitments and honors her work with integrity and confidentiality. As Cherrylane pivots into the BPO (Business Process Outsourcing) industry, her advanced customer service experience is extremely useful in ensuring customer satisfaction and support. She has worked and interacted with people from diverse cultures and from all walks of life, making her personable and empathetic. We’re thrilled to have her as part of our operations team. Emily is originally from Los Angeles, California, and graduated from Chapman University with a degree in Business Communication. Her first experience in a leadership role was as a department manager at Nordstrom. It was here she developed her skills in people management as well as client retention. She was awarded with a “Customer Service All-Star” award by the CEO for her creative problem-solving skills and stellar success in giving customers the utmost best service. Following this chapter, she moved her expertise into a Project Management role at an Architectural Engineering company in Southern California. It was here she found her passion for home design and ultimately real estate. With Emily’s combined people skills and passion for the business of real estate and property management, she is thrilled to help grow all facets of KeyOpp.

Emily is originally from Los Angeles, California, and graduated from Chapman University with a degree in Business Communication. Her first experience in a leadership role was as a department manager at Nordstrom. It was here she developed her skills in people management as well as client retention. She was awarded with a “Customer Service All-Star” award by the CEO for her creative problem-solving skills and stellar success in giving customers the utmost best service. Following this chapter, she moved her expertise into a Project Management role at an Architectural Engineering company in Southern California. It was here she found her passion for home design and ultimately real estate. With Emily’s combined people skills and passion for the business of real estate and property management, she is thrilled to help grow all facets of KeyOpp. Katrina embarked on her professional journey as a Digital Marketing Specialist in Real Estate right after graduating in 2019 with a Bachelor of Arts in Business Administration, majoring in Marketing Management.

Katrina embarked on her professional journey as a Digital Marketing Specialist in Real Estate right after graduating in 2019 with a Bachelor of Arts in Business Administration, majoring in Marketing Management.

Kristine Cordenillo’s fascination with the concept of home got her into the property management industry. She believes the home is a significant factor in shaping a person’s identity. She was previously a Lease Management Manager for a property management company based in Michigan for about five years. She is currently a candidate for a degree in Masters in Anthropology.

Kristine Cordenillo’s fascination with the concept of home got her into the property management industry. She believes the home is a significant factor in shaping a person’s identity. She was previously a Lease Management Manager for a property management company based in Michigan for about five years. She is currently a candidate for a degree in Masters in Anthropology. Calvin Yu is a seasoned professional with a decade of diverse experience, underpinned by a foundation in Business Administration from San Francisco State University. His career trajectory includes roles in food service, project management, and as a production associate at Tesla, each contributing to his robust skill set. In these roles, Calvin has demonstrated his ability to thrive in fast-paced environments, showcasing his hardworking nature, diligence, and patience. His time in the food service industry refined his customer service and operational skills, while his project management experience enhanced his strategic planning and problem-solving capabilities. At Tesla, he embraced the challenge of precision and innovation, further solidifying his adaptability and commitment to excellence.

Calvin Yu is a seasoned professional with a decade of diverse experience, underpinned by a foundation in Business Administration from San Francisco State University. His career trajectory includes roles in food service, project management, and as a production associate at Tesla, each contributing to his robust skill set. In these roles, Calvin has demonstrated his ability to thrive in fast-paced environments, showcasing his hardworking nature, diligence, and patience. His time in the food service industry refined his customer service and operational skills, while his project management experience enhanced his strategic planning and problem-solving capabilities. At Tesla, he embraced the challenge of precision and innovation, further solidifying his adaptability and commitment to excellence. Anupama’s journey began with a deep curiosity for design, leading her to complete a 3-year diploma in Design and Animation. However, her passion for Marketing and Real Estate soon took center stage. With 10 years of experience, she has helped brands scale and thrive by crafting strategic, data-driven solutions and building a strong digital presence.

Anupama’s journey began with a deep curiosity for design, leading her to complete a 3-year diploma in Design and Animation. However, her passion for Marketing and Real Estate soon took center stage. With 10 years of experience, she has helped brands scale and thrive by crafting strategic, data-driven solutions and building a strong digital presence.